Did you know that the cryptocurrency market was created only 14 years ago?

.

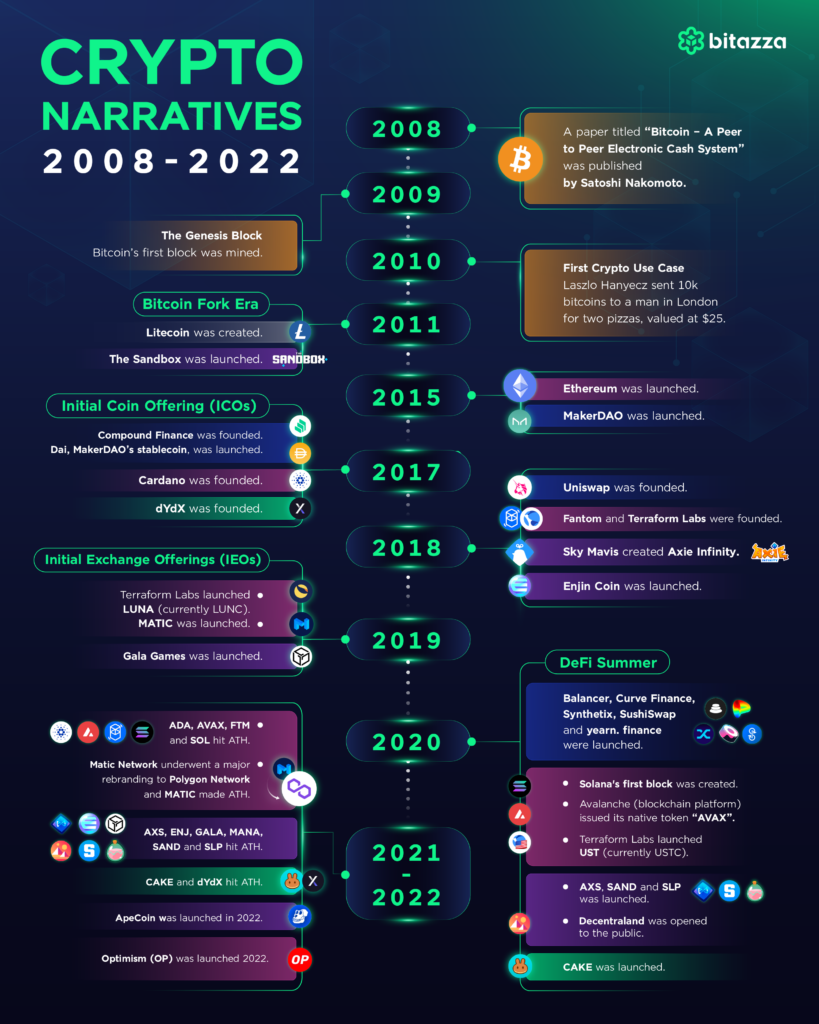

Let’s go on the time machine with a brief timeline of digital assets that have changed the world. From the first cryptocurrency to Metaverse, we have been through many evolutions that grow with new technology, actual use cases, the global economy, and us, traders who adopted and used cryptocurrency in our daily lives. The infographic below provides a brief overview of the cryptocurrency narratives.

Bitcoin The world’s first cryptocurrency

A paper titled Bitcoin: A Peer-to-Peer Electronic Cash System was posted on Oct. 31, 2008, to a cryptography mailing list with “Satoshi Nakamoto” as the author. However, Nakamoto has never revealed personal information about himself, and his identity has never been confirmed.

Laszlo Hanyecz first used Bitcoin by purchasing two Papa John’s pizzas for 10,000 Bitcoins. (Fun fact: That amount of Bitcoin is worth over $240 million as of this writing).

Bitcoin Fork Era

After Bitcoin was launched, many developers were already inherent in Satoshi’s initial program and concept. Others take the bitcoin model and adapt or attempt to improve upon it.

The most popular cryptocurrency derived from Bitcoin is Litecoin (LTC). It was adapted from Bitcoin’s open-source code but with several modifications, including cheaper fees, faster, and more decentralized.

The creation of Ethereum

The introductory paper was published in 2013 by Vitalik Buterin, the founder of Ethereum, before the project’s launch in 2015.

Ethereum involves blockchain technology validated by a network of automated programs that reach a consensus on the validity of transaction information. Ethereum uses the proof-of-work protocol, where a network of participants runs software that attempts to prove that an encrypted number is valid.

**As of now, Ethereum 2.0 “The Merge” is in its final stages of testing and is expected to be deployed on the Ethereum mainnet soon. The upgrade will mark the end of Proof-of-Work for Ethereum and a complete transition to Proof-of-Stake as the consensus mechanism for the Ethereum blockchain.

DeFi on Ethereum

Decentralized finance (DeFi) uses cryptocurrency and blockchain technology to manage financial transactions. DeFi aims to democratize finance by replacing legacy, centralized institutions with peer-to-peer that can provide a full spectrum of financial services, from everyday banking, loans, and mortgages, to complicated contractual relationships and asset trading.

MakerDAO (MKR) is a peer-to-peer organization created on the Ethereum network to allow people to lend and borrow using cryptocurrencies. The MKR token controls the MakerDAO ecosystem. Holders of the token can control different aspects of the Maker Protocol, including the amount of collateral for CDPs, annual borrowing, and shutting down in case Ethereum crashes.

Compound Finance (COMP) is a marketplace to lend and borrow digital assets, including ETH, USDC, Dai, and USDT. Users can also vote on the governance structure of the Compound protocol using the COMP token.

Uniswap (Uni) is a decentralized protocol for automated liquidity provision on Ethereum. Users can tap into this liquidity and swap between ERC-20 tokens freely in a non-custodial manner. In addition, UNI is a token that will be used in the protocol’s governance, including the community treasury, protocol fee switch, and many more.

Layer-1 Projects

Amid the rapid growth of decentralized finance (DeFi) and non-fungible tokens (NFTs), Ethereum is facing scalability issues as its applications and users continue to grow, which causes the system to be congested.

Additionally, the Ethereum network uses a Proof-of-Work (PoW) to verify transactions. This makes systems that require more time and energy to process as well. As a result, developers created another Layer 1 platform to solve these issues.

Solana (SOL) is a layer-1 blockchain network that can process up to 50k transactions per second. They focus on scalability, security, and decentralization and are compatible with Smart Contracts allowing for DeFi projects, DApp, and Stablecoins to launch on the blockchain. Solana’s consensus mechanism is a combination of proof of stake and proof-of-history used to validate transactions.

Avalanche(AVAX) is an EVM-compatible Smart Contract platform and platform for building custom blockchain networks and is the fastest Smart Contract platform. AVAX is the native token of the Avalanche platform. It is used to secure the network through proof-of-stake on its Avalanche Consensus mechanism, pay for fees, and provide a basic unit of account between the subnetworks created on the Avalanche platform. In addition, all fees paid on the network are burned as a deflationary mechanism.

Fantom (FTM) is a Smart Contract platform powered by Lachesis, Fantom’s innovative DAG-based aBFT consensus algorithm that process transaction within 2 seconds at a cheap cost. Fantom’s Lachesis protocol is also fully compatible with the Ethereum Virtual Machine, making Fantom flexible for developers.

Alternative DeFi on non-ETH Chains

Besides DeFi on Ethereum, there is also DeFi built to optional Layer-1 projects as well.

DYDX (dYdX) is the governance token for the layer 2 protocol of the eponymous non-custodial decentralized cryptocurrency exchange on Ethereum. Token holders are granted the right to propose changes on the dYdX’s layer 2, and are presented with an opportunity to profit through token staking and trading fee discounts.

PancakeSwap is a decentralized exchange on the Binance Smart Chain that allows users to trade between different BEP20 tokens. CAKE token is PancakeSwap’s native governance token used to incentivize users to provide liquidity on the PancakeSwap platform. CAKE can also be staked, used to enter PancakeSwap’s 6-hour lottery, and traded CAKE for exclusive PancakeSwap NFTs.

Gamefi, NFT, Metaverse

The Sandbox is a fully decentralized, Ethereum-based virtual world that allows players to build, own, and monetize their gaming experience with the disruptive potential of decentralized autonomous organizations (DAOs) and NFTs to create the Play-to-Earn revolution that is changing the gaming industry. The Sandbox ecosystem comprises three integrated products that facilitate the production of User-Generated Content that keeps the platform community-driven. These include VoxEdit, Marketplace, and Game Maker, which allow users to create, sell and play their virtual assets easily.

Axie Infinity is an Ethereum-based game developed by Sky Mavis that combines the best parts of RPGs with the blockchain to reward players for their contribution to the ecosystem. Axie Infinity is one of the pioneers of the play-to-earn gaming model. They have 2 main tokens.

- Smooth Love Potion (SLP) is an ERC-20 token used in the Axie Infinity ecosystem to breed Axies

- Axie Infinity Shard (AXS) is the ERC-20 governance token of the Axie Infinity ecosystem that represents community ownership of the game universe and will allow holders to stake and receive AXS from voting and playing the game. AXS has a total supply of 270 million.

ApeCoin (APE) is the ERC20 governance and utility token of the APE ecosystem. APE can be used to participate in the Apecoin DAO, as a currency on the platform, to access exclusive areas of the APE ecosystem, and as an incentive for developers to build on the APE ecosystem. The APE ecosystem consists of a growing stable of interconnected Metaverse and NFT projects, including the Bored Ape Yacht Club (BAYC) and the Mutant Ape Yacht Club (MAYC). It is designed as a decentralized protocol layer that supports art, gaming, entertainment, and events on Web3.

You might also like

More from Educational

Getting Started with DeFi Protocols

What is DeFi Protocol? A DeFi Protocol, or Decentralized Finance Protocol, is a system within the decentralized finance (DeFi) space that …

Mastering Money Management Based on the Risks of 4 Coin Categories

Mastering Money Management Based on the Risks of 4 Coin Categories Although it is said that cryptocurrencies are volatile, in reality, …

Wolrdcoin (WLD) Infographic

After getting to know more about SUI coin, let's now familiarize ourselves with another hot coin, WLD, which is one …