Crypto Weekly: 10 – 16 October 2022

According to a new study published by the Basel Committee on Banking Supervision, 19 out of 182 global banks supervised by the committee reported that they owned digital assets. Combined, their total exposure to Crypto is estimated to be 9.4 billion euros ($9.38 billion). This amount represents 0.14% of the total risk-weighted asset composition of the 19 crypto-owning banks surveyed. Reported digital exposures primarily consisted of Bitcoin and Ether, at 31% and 22% of total holdings, respectively.

Fumio Kishida, the prime minister of Japan, has said the government will be making efforts to promote Web3 services, including those dealing with nonfungible tokens, or NFTs, and the Metaverse as part of Japan’s digital transformation strategy. Kishida specifically highlighted the government-issued NFTs awarded to local authorities who succeeded at using digital technology to solve local challenges and hinted at expanding this Web3 adoption to potentially digitizing national identity cards.

NEAR Foundation has announced a partnership with Google Cloud, with the latter set to provide the infrastructure for Web3 developers building on Remote Procedure Call (RPC) node provider to Pagoda, NEAR’s Web3 startup platform, allowing developers to deploy code securely and seamlessly.

Bitcoin Layer-2 payment solution Lightning Network reached a milestone capacity of 5,000 BTC, worth over $96 million at the time of writing. This indicates that more Bitcoin is being introduced to Lightning Network payment channels as Bitcoin users worldwide continue to support the growth of the network despite current bearish market conditions for BTC.

Bitcoin hash rate surged to all-time highs in October, jumping by 10.8% and setting a new Total Hash Rate peak at 258.339 TH/s. This increase in hash rate could potentially be attributed to falling mining rig prices, with miners able to run more powerful mining rigs at a comparatively lower price point than before. Additionally, since China’s blanket ban on Crypto, other countries, including Kazakhstan, Canada, Germany, and others, have proven to be successful relocation alternatives for Bitcoin miners looking to continue operations away from draconian Chinese regulations.

BNB Chain was forced to temporarily suspend network operations following a $100M cross-chain bridge exploit. Hackers were able to exploit a vulnerability in BSC Token Hub, a BNB Beacon Chain, and BNB Smart Chain bridge to fraudulently mint 2 million BNB. The hackers were able to withdraw nearly $118 million in stolen funds before network activity was suspended. Binance has allegedly managed to freeze $7 million of the siphoned funds, bringing the actual hack amount to $100 million – $110 million, according to Binance. The exploit revolved around the extra BNB minted, and Binance CEO Changpeng Zhao has publicly confirmed that no users have lost their money and that their assets are safe.

South Korean authorities have officially voided TerraForm Lab’s founder Do Kwon’s passport and has given Kwon 14 days to surrender his passport to authorities. Additionally, South Korean authorities have reportedly arrested TerraForm Lab’s Head of General Affairs.

Weekly Technical Analysis: 10 – 16 October 2022

Bitcoin (BTC)

BTC is directionless and trending sideways at the moment. However, BTC has managed to outperform other assets like gold and stocks as investors react to the continued strengthening of the US Dollar Index. Keep a close eye on BTC’s support and resistance levels at $17,500 and $20,500, respectively. Investors should consider waiting for BTC’s direction to become clearer before committing to a position.

Ethereum (ETH)

ETH’s trend remains ambiguous, with prices trending sideways. Initial support is set at the $1,200 level, with another critical support level at $1,000. If the support level can remain intact, ETH will look to test its $1,500 resistance level in the short term before targeting the $1,800 level if succesful.

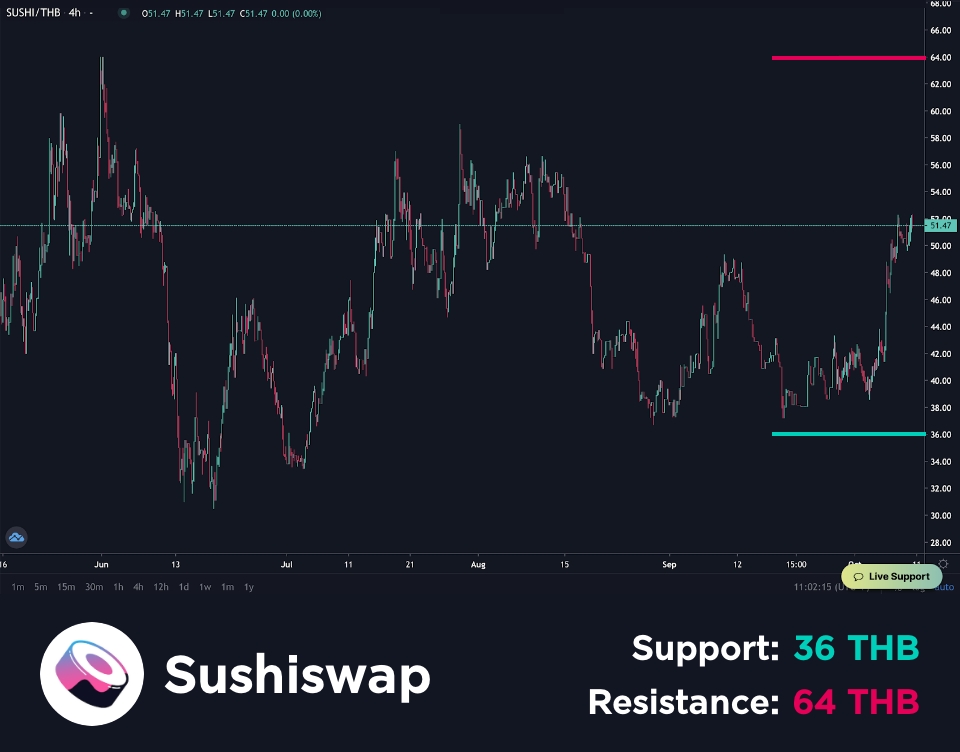

SushiSwap (SUSHI)

SUSHI is up by +31.9% from last week. Despite this, its overall picture remains bearish. Investors are advised to exercise high caution before committing to entering a position. Keep an eye on support at the 38 baht mark. If support cannot remain intact, this could trigger a market-wide sell-off as investors look to cut their losses. Resistance for SUSHI is set at the 64 baht level.

Ethereum Name Service (ENS)

ENS is up by +24.5% from the past week; however, its overall trend remains bearish. Investors are advised to focus on short-term strategies only. The first support for ENS that could potentially be a profitable entry point is at 440 baht. Resistance is set at 920 baht.

Trading and Investment Considerations For The Week

The recent better-than-anticipated US Nonfarm Payroll figures triggered a sell-off for the stock market, gold, and Bitcoin, with investors concerned that the positive employment figures will give the FED the confidence they need to continue enacting increasingly hawkish monetary policy. Despite the sell-off, Bitcoin looks stronger than many assets, with the Crypto market leader refraining from hitting new lows.

On Wednesday, 12 October, the minutes from the previous FED will be released; however, there is little expectation of anything in the minutes that could have a substantial impact on the market. On 13 October, US inflation figures for September will be released, which could prove to be significant.

Market sentiment expects inflation rates to be at the 8.1% mark. If the released figures are lower than expectations, this could reduce pressure on the FED to accelerate interest rate hikes. However, a higher-than-expected inflation rate increase could negatively impact the market as this would give regulators the justification they need to continue increasing interest rates at an accelerated pace. This week also keep an eye on economic announcements from the UK and the EU, which could affect the strength of the US dollar.

The Crypto market is still devoid of any positive factors that could spur an upwards reversal. On the contrary, macroeconomic factors like the escalating Russia-Ukraine conflict, a potential global recession, and the defaulting of emerging countries on debts could negatively impact the Crypto market. Traders are advised to keep a close eye on potential negative factors as they could cause Bitcoin prices to fall to new lows if the situation worsens.

Disclaimer:

-Cryptocurrency and Digital tokens are highly risky; investors may lose all investment money. Investors should study information carefully and make investments according to own risk profile.

– Past Returns/Past Performance does not guarantee future returns/performance.

*Materials on Bitazza Weekly Newsletter are intended to be used and must be used for informational purposes only. The views, information, or opinions expressed are solely those of the individuals involved and do not necessarily represent those of Bitazza and its employees. The information contained herein is not intended to be a source of advice or financial analysis with respect to the material presented, and the information and/or documents contained in this website do not constitute investment advice.

Sources:

https://blog.coin98.com/introducing-cusd/

You might also like

More from Crypto Weekly

Bitcoin drops sharply before the fourth halving

The fourth Bitcoin halving, which will cut the new daily mining supply in half, is expected to happen on April …

Memecoins Top Charts with Best Returns of Q1

CoinGecko reported memecoins achieving the highest returns in the first quarter of 1,312.6%, surpassing second-placed RWA (real world asset) tokens …

Staking Investment Firm’s Features Fuels Interest in Ethereum ETFs

Larry Fink, Blackrock's CEO, expressed his belief that a Spot Ethereum ETF will eventually be approved, despite the SEC's classification …