Getting To know: Relative Strength Index

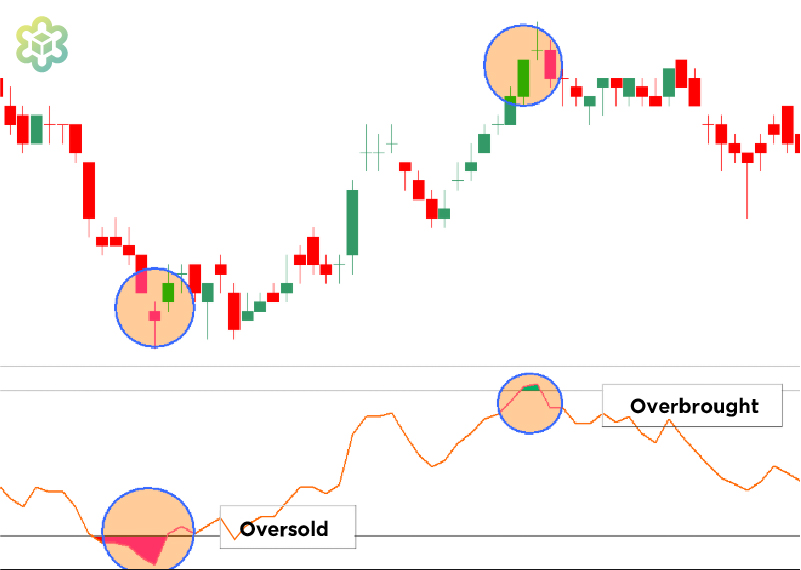

Relative Strength Index, or RSI is a popular indicator used by many technical analysts and traders. RSI helps traders evaluate the strength of the market by providing guidance that helps identify overbought or oversold conditions in the market.

The RSI indicator consists of a single line and an index from 0-100. The index is basically categorized into 3 different zones.

0 – 30 : Oversold

30-70 : Neutral

70-100 : Overbought

Typically, oversold market conditions indicate a possibility of price bouncing back up. It could also sometimes indicate that prices have entered into bearish territory.

The opposite is true for overbought market conditions.

RSI Divergence is the last RSI strategy we will discuss. If you are already familiar with divergence on other indicators such as Stochastics or MACD, RSI divergence can provide a trading opportunity.

What is a Divergence? Divergence is when the price of an asset is moving in the opposite direction of a technical indicator, such as an oscillator, or is moving contrary to other data. Divergence warns that the current price trend may be weakening, and in some cases may lead to the price changing direction – investopedia.com

Bullish RSI Divergence – Price is creating a lower low whilst RSI indicator is creating a higher low

Bearish RSI Divergence – Price is creating higher whilst RSI Indicator is creating a lower high

However, not all divergences play out as they should. During times when the market trend is strong, you may see the RSI indicator cool off while price continues to create higher highs (bullish senario). But instead of a price reversal on the bullish RSI divergence setup, price continues to shoot up higher (fakeouts)

To conclude, the RSI indicator should not be used as a standalone indicator for your trading strategy. Add other indicators and strategies to filter out fake signals. Good luck!

You might also like

More from Blockchain

Bitazza Token Listing Announcement: STX — Get to Know Stacks

We’re excited to announce that Stacks (STX) is now listed on Bitazza! You can now buy, sell, and trade Stacks along …

Getting Started with DeFi Protocols

What is DeFi Protocol? A DeFi Protocol, or Decentralized Finance Protocol, is a system within the decentralized finance (DeFi) space that …

What was the excitement after the approval of the Bitcoin ETF?

Many new investors may still be wondering whether the approval of the Bitcoin ETF by the U.S. SEC is a …