![]() Are stablecoins STABLE as you think?

Are stablecoins STABLE as you think?

.

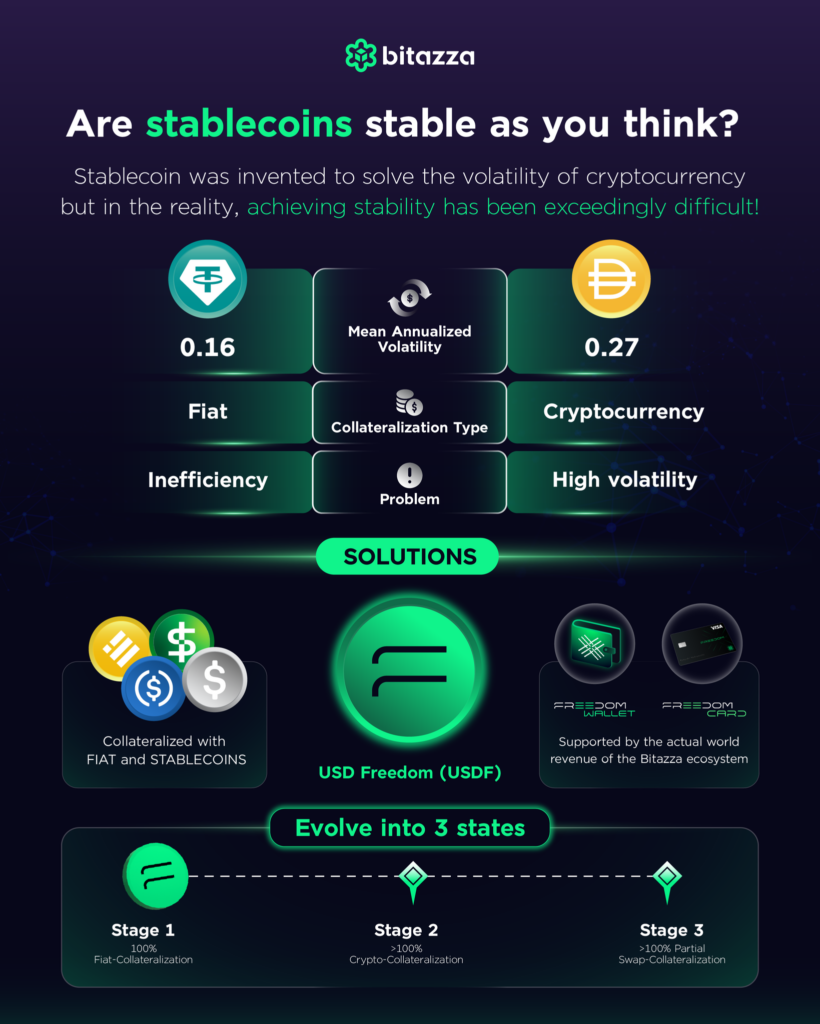

While stablecoins were invented to be pegged to a dollar despite the market volatility, according to Bitazza Global Whitepaper 2.0, achieving stability has been exceedingly difficult in practice.

.

For example, USD Tether (USDT), the world’s most used stablecoin, is fully collateralized with cash and still has a mean annualized volatility of 0.16* and inherent capital inefficiency, which impedes growth of a stablecoin’s market capitalization. While crypto-collateralized stablecoin like DAI also has a mean annualized volatility of 0.27*, which is higher than fiat-collateralized stablecoins.

.

![]() What’s the sustainable solution?

What’s the sustainable solution?

.

Freedom has incorporated competent solutions into USD Freedom (USDF), the 100% fiat-backed U.S. dollar stablecoin that is entirely collateralized using fiat (U.S. Dollar) or fiat-backed stablecoins (BUSD, USDP, USDC, and more) in its reserves to maintain its 1:1 USD peg.

.

USDF was designed to evolve into three states to mitigate risks during market volatility and build trust for holders as needed through utilities, e.g., trading, stake to earn yield, lending or collateralization, used across multiple chains, access to exclusive discounts, Freedom Wallet, and Freedom Card, to help expand the ecosystem.

.

Read more about USDF and stablecoins here ![]() https://bit.ly/FBTH_EN_WHITEPAPER2

https://bit.ly/FBTH_EN_WHITEPAPER2

.

*Data from Bitazza Global Whitepaper 2.0

More from Whitepaper 2.0

The Tokenomics of BTZ

After your participation in voting for the BTZ coin to be listed on Bitazza exchange via Freedom DAO using Freedom …

Bitazza Global whitepaper 2.0 HIGHLIGHT!

Let us help you digest Bitazza Global Whitepaper 2.0 with the summary of highlight key topics all-in-one page! Then feel free …

How USD Freedom (USDF) was issued by Freedom?

Get to know more about how USD Freedom (USDF) issued by Freedom is minted in the initial stages has been minted …