COVID-19: Build or Rebuild The Age of Convenience

It is safe to say by now that Covid-19 has upended our lives in ways we’d never imagine, and that 2021 might just be virtually unrecognisable from 2019. All these changes may seem too overwhelmingly fast, daunting even, but is it really?

Dance clubs have started live streaming their events for a global audience that wants to party but can’t leave home. Similarly, people who have spent decades in offices, not missing a meeting, are now starting to discover they could do all that from home too. Everything that we have gotten used to is now being forced to change temporarily. But what is temporary when there is no end date?

Inconvenience in The Age of Convenience

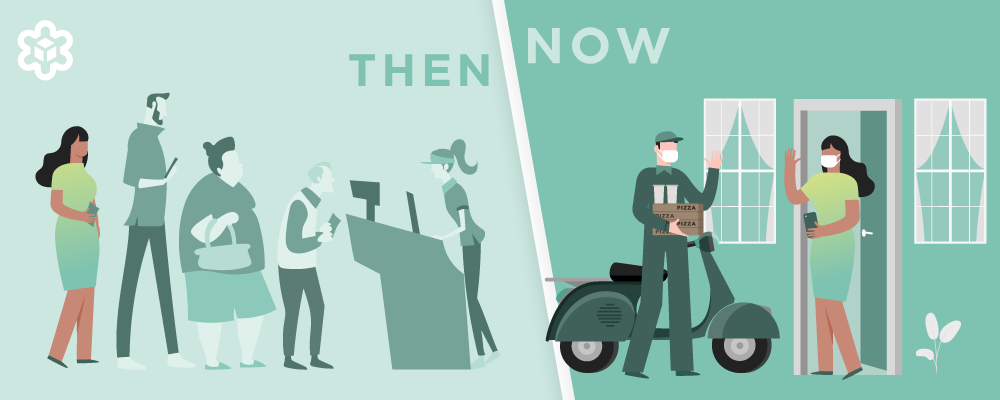

In the age of convenience, services are brought to you, instead of you having to look for them. This is why food delivery seems a much better option than dining in, or transferring money to someone else can be done in seconds. The best part? You don’t even need to move.

We have become so used to this convenience that queuing up for a table at a restaurant, queuing up at a bank, or just queuing up for anything that can easily be done online have all become distant memories even before the virus appeared.

However, convenience doesn’t necessarily mean anything if the dish you’re looking for at the restaurant is no longer available, or the currency itself you’re holding in your account might one day not be as valuable as it is today.

Now with the disease raging on globally, and with no clear projections on when or how it will end, it has created unprecedented levels of chaos and uncertainty that has plunged stock markets and crashed economies and in short, left a major inconvenience in the age of convenience!

There is No Cure nor Immunity For Markets Either

Covid-19 has shown us that no man-made system is infallible. Some major corporations are barely struggling to survive, some governments have been forced to dig into their federal reserves to keep their countries running. We can only imagine what this means for the rest of us.

The traditional financial system has been facing a barrage of hits from the effects of the virus and this in turn, will weaken our respective currencies if it already hasn’t. The money in your bank might represent a slightly different value next year, even if the amount remains the same. Central Banks will be forced to print more fiat money to support economies with no real GDP

In times of crisis, managing your own wealth or assets will give you a better sense of security. You can empower yourself not to be reliant on a centralised system to hold all your assets.

It Could Still Be a Lifeline

Although digital assets were not spared entirely from this virus, there are two simple reasons why it might still be wise to consider the longevity and sustainability of digital assets as opposed to traditional money in the long run.

1. You own your assets – Unlike traditional currencies that are reliant on trade or the economy, and where you might just lose your money like what happened during the Cyprus bank disaster back in 2013, digital assets like cryptocurrencies are owned by you, protected in your personal wallet with your keys.

2. It can be used as a currency – In the event that your money is no longer able to fulfil its primary function, cryptocurrency might be next in line to replace it — especially those regulated by their respective governments like in Thailand, or linked to the country’s central banking system like in China.

There Might Be A Light

Although the world hasn’t yet felt the full effects of Covid-19, it is quite clear by now that life will never be the same again. However, it could be for the better as many new ideas have come to life and are being implemented during these times. Ideas that will shape the next few decades, from remote working to food delivery paid for in cryptocurrency — and some of these ideas are being developed in southeast Asia too.

We don’t have to build or rebuild from the age of convenience, it never ended.

We just need to innovate and evolve, so that we can buy what we want and get them sent to us, transfer funds securely and safely to our loved ones, watch our favourite movies or listen to our favourite music or even buy tickets and watch our friends’ bands perform — all from the convenience of our screen, paid for securely by us, without using any traditional money.

Actually, that reality has already begun. Bitazza is providing support to keep traders safe and support local businesses to get through these tough times amidst other community-driven initiatives and if it takes off, it might just be the start of a new era even beyond Thailand.

You might also like

More from Blockchain

Bitazza Token Listing Announcement: STX — Get to Know Stacks

We’re excited to announce that Stacks (STX) is now listed on Bitazza! You can now buy, sell, and trade Stacks along …

Getting Started with DeFi Protocols

What is DeFi Protocol? A DeFi Protocol, or Decentralized Finance Protocol, is a system within the decentralized finance (DeFi) space that …

What was the excitement after the approval of the Bitcoin ETF?

Many new investors may still be wondering whether the approval of the Bitcoin ETF by the U.S. SEC is a …