The economy moves in predictable cycles with ups and downs as investors try to anticipate the next cycle months in advance. So they move their money into the industries that tend to perform best in the next cycle, creating “Sector rotation ” or the movement of money invested from one industry to another. For example, During “Market Bottom”, medical, health, and consumer products are where money rotated to as its basic human needs. Or, During Bull Market, investors start looking into forward-looking sectors like Technology.

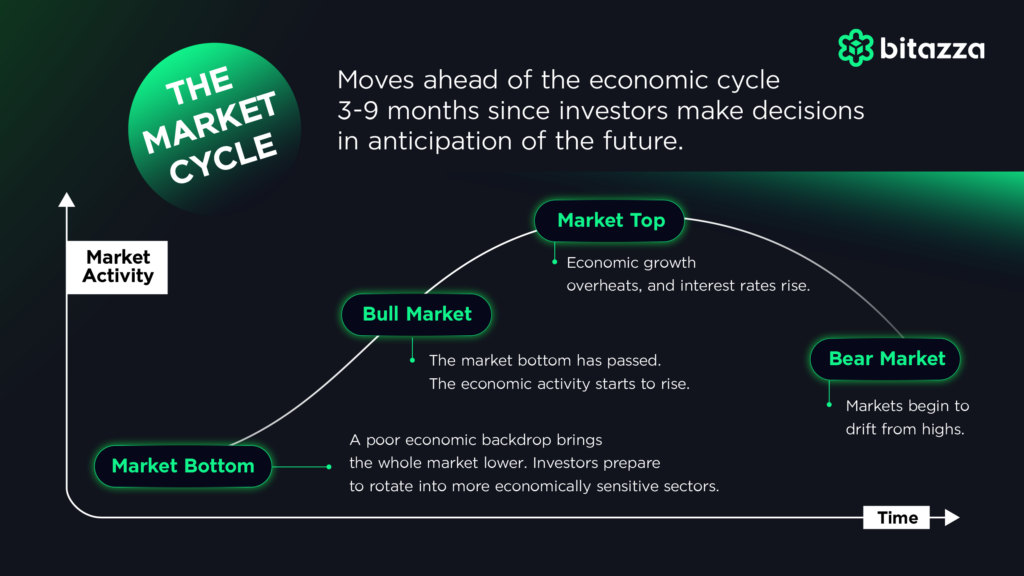

The Market Cycle

They move ahead of the economic cycle 3-9 months since investors make decisions in anticipation of the future.

Market bottom: A poor economic backdrop brings the whole market lower. Investors prepare to rotate into more economically sensitive sectors.

Bull market: The market bottom has passed. The economic activity starts to rise.

Market top: Economic growth overheats, and interest rates rise.

Bear market: Markets begin to drift from highs.

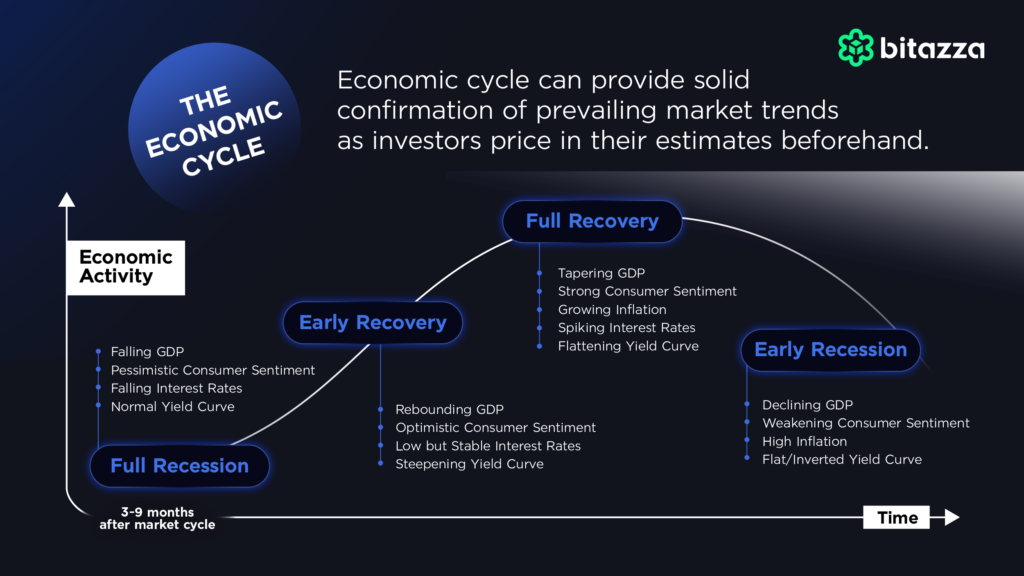

The Economic Cycle

They can provide solid confirmation of prevailing market trends as investors price in their estimates beforehand.

Full Recession

- Falling GDP

- Pessimistic Consumer Sentiment

- Falling Interest Rates

- Normal Yield Curve

Early Recovery

- Rebounding GDP

- Optimistic Consumer Sentiment

- Low but Stable Interest Rates

- Steepening Yield Curve

Late Recovery

- Tapering GDP

- Strong Consumer Sentiment

- Growing Inflation

- Spiking Interest Rates

- Flattening Yield Curve

Early Recession

- Declining GDP

- Weakening Consumer Sentiment

- High Inflation

- Flat/Inverted Yield Curve

🪙What about the crypto market?

There isn’t a clear analogy in the crypto market since most cryptocurrencies fall within one broad industry like Technology, and most projects fall within a few sectors, e.g., finance, investment, gaming, etc.

📝How can I benefit from this?

To apply the market and the economic cycle with cryptocurrency, you can still target investments based on risk appetite that varies with cycles. For example, when people invest in riskier products again, the least risky ones like BTC and ETH would likely benefit first.

Finally, past performance isn’t always indicative of future results. Therefore, it is best for you to #DYOR or “do your own research” to sharpen your investment decision-making and always look for the brighter side!

You might also like

More from Educational

Getting Started with DeFi Protocols

What is DeFi Protocol? A DeFi Protocol, or Decentralized Finance Protocol, is a system within the decentralized finance (DeFi) space that …

Mastering Money Management Based on the Risks of 4 Coin Categories

Mastering Money Management Based on the Risks of 4 Coin Categories Although it is said that cryptocurrencies are volatile, in reality, …

Wolrdcoin (WLD) Infographic

After getting to know more about SUI coin, let's now familiarize ourselves with another hot coin, WLD, which is one …