Ethereum Rallies on Prospect of ETF Opportunities for Institutional Investors

BlackRock has registered the iShares Ethereum Trust in Delaware, USA, leading to a significant increase in Ethereum’s price, which reached the $2,000 mark. This development has raised expectations for the launch of an Ethereum ETF, akin to those available for Bitcoin.

In a related development, BlackRock has argued with the U.S. Securities and Exchange Commission (SEC) over the treatment of ETFs that invest in spot crypto markets versus those in futures markets. BlackRock contends that differing approaches to these could result in legal complications.

Matrixport’s analysis indicates that Ethereum’s blockchain fee revenue has surpassed its lowest point. Gas fees have consistently stayed above $30 million for two weeks, a significant increase from the annual low of $12 million in early October. This suggests that Ethereum is moving out of a period of low activity.

The CEO of Hong Kong’s Securities and Futures Commission is considering allowing retail investors to directly invest in digital asset ETFs like Bitcoin. Currently, Hong Kong has registered three funds based on Bitcoin and Ethereum futures.

The U.S. SEC has reopened negotiations with Grayscale Investments about converting the GBTC fund into a spot Bitcoin ETF. This comes after a federal court ruling required the SEC to reconsider Grayscale’s application for a Spot Bitcoin ETF.

Analysts from Bloomberg Intelligence believe there is over a 90% chance that a Bitcoin ETF will be approved by January 10, 2024. This is due to the time required to review applications from all 14 applicants, likely leading to simultaneous approval.

Crypto market analyst Lark Davis views Chainlink and Solana as potential next points of interest for institutional investors following Bitcoin and Ethereum. He suggests that these coins could also have ETFs in the future, providing institutional investors with more investment options.

Weekly Technical Analysis: 14 – 20 November 2023

Bitcoin (BTC)

BTC has reached the resistance level of $38,000 and is currently moving sideways without a clear direction. It’s important to keep an eye on a potential correction as a Bearish Divergence is starting to form in the RSI. The first support level is estimated at $34,000, while the resistance level has been raised to $40,000. If this is breached, the next target is $42,000.

Ethereum (ETH)

ETH has shown a strong uptrend following news of an upcoming ETF. The momentum looks positive. The support level is at $1,900, which could be a good entry point if the price retracts. The first resistance level is at $2,200.

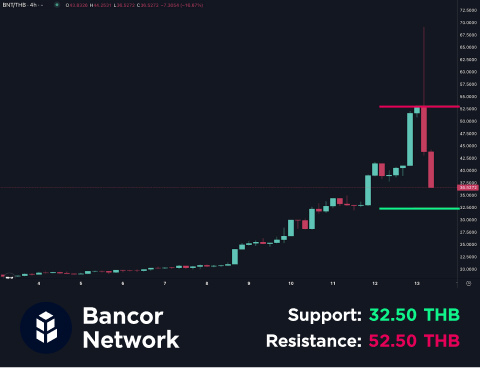

Bancor Network (BNT)

BNT has increased by 96.8% over the past week. However, the rapid price surge could lead to significant selling pressure. The key support level to watch is 32.50 THB.

Terra (LUNA)

LUNA has risen by 69.9% in the past week. However, traders should exercise caution as this increase is linked to speculative trading amid news of FTX resuming services.

Trading and Investment Considerations For The Week

Even though Bitcoin’s price has started to stabilize, Altcoins in the DeFi, GameFi, and Blockchain Layer 1 and 2 categories continue to see ongoing speculative trading. This is viewed as an opportunity for short-term investment.

It is expected that the market will remain lively until the end of the year or until a Bitcoin ETF is officially approved, which may lead to a ‘Sell On Fact’ situation. Ethereum is seen as a promising alternative, especially after the news of the ETF setup, and it still lags 50% behind BTC in price this year.

The U.S. stock market, particularly the Nasdaq, continues to rise, positively impacting the digital asset market due to their close correlation. These markets have shown resilience against the strengthening U.S. dollar and the rising yields of U.S. government bonds.

On Tuesday, November 14, the U.S. CPI Index figures will be announced. The market expects it to be around 3.3%, down from 3.7% the previous month. A decrease in inflation would be positive for the market as it would reduce pressure on the U.S. Federal Reserve to hike interest rates, despite recent indications that another rate increase is possible.

More from Crypto Weekly

Hong Kong Starts Trading Spot BTC-ETH ETFs This Week

Hong Kong is preparing to officially launch the trading of Spot Bitcoin and Ethereum ETFs on April 30. The fund …

Bitcoin Halving Done, Bull Market Awaits

On April 20th, the fourth Bitcoin Halving occurred successfully at block 840,000, mined by ViaBTC. This block contained 3,050 transactions, …

Bitcoin drops sharply before the fourth halving

The fourth Bitcoin halving, which will cut the new daily mining supply in half, is expected to happen on April …